Overview of 源泉徴収票 [GENSEN CHOUSYU HYOU](げんせんちょうしゅうひょう)

Companies fulfill their tax obligations on behalf of all employees who work for the company. Therefore, calculating the amount of withholding and preparing the necessary documents, such as the withholding tax form, is an important payroll task.

A withholding tax form is a document issued by your employer that shows how much you have been paid for the year and how much tax you have collected.

Your employer will issue a Gensen Choshuhyo at the end of each year for each of your employees.

The employer is also obligated to issue a withholding tax form based on the employee’s pay from January 1 to the time of retirement, even when the employee leaves the company. This will be used for the employee’s own 確定申告 [KAKUTEI SHINKOKU] (かくていしんこく) “tax return” and for the 年末調整 [NENMATSU CHOUSEI] (ねんまつちょうせい) “year-end adjustment” at the next place of employment.

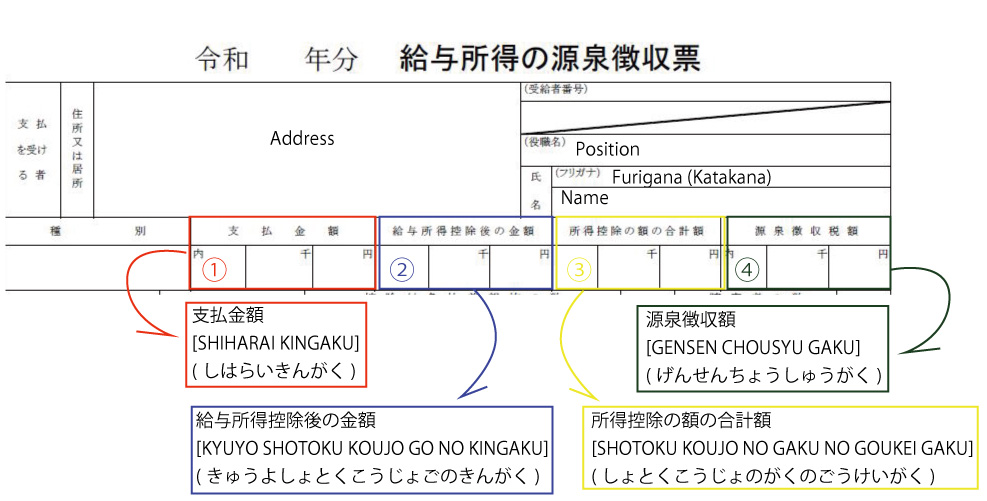

Interpretations of 源泉徴収票 [GENSEN CHOUSYU HYOU](げんせんちょうしゅうひょう)

① 支払金額 [SHIHARAI KINGAKU] (しはらいきんがく)

This is the total amount of salary, overtime, bonuses, and other benefits, which is listed for one year and is roughly equal to your annual salary. Allowances such as commuting expenses and travel and accommodation expenses are not included in this amount.

② 給与所得控除後の金額 [KYUYO SHOTOKU KOUJO GO NO KINGAKU] (きゅうよしょとくこうじょごのきんがく)

給与所得控除 [KYUYO SHOTOKU KOUJO] (きゅうよしょとくこうじょ) : Based on the idea that employees as well as the company have their own expenses, the system allows employees to reduce their taxes by deducting a certain amount from their annual income as an expense.

給与所得控除後の金額 [KYUYO SHOTOKU KOUJO GO NO KINGAKU] (きゅうよしょとくこうじょごのきんがく) is the amount of money deducted based on your annual income.

③ 所得控除の額の合計額 [SHOTOKU KOUJO NO GAKU NO GOUKEI GAKU] (しょとくこうじょのがくのごうけいがく)

The total amount of all deductions other than “給与所得控除 [KYUYO SHOTOKU KOUJO] (きゅうよしょとくこうじょ)” is listed here. This total includes the following two major deductions

– The amount you have been deducting in your monthly payroll calculation.

This is the total annual amount of 健康保険料 [KENKOU HOKEN RYOU] (けんこうほけんりょう) “health insurance premiums”, 厚生年金保険料 [KOUSEI NENKIN HOKEN RYOU] (こうせいねんきんほけんりょう) “employee pension insurance premiums”, 雇用保険料 [KOYOU HOKEN RYOU] (こようほけんりょう) “unemployment insurance premiums”, and 企業共済掛金 [KIGYOU KYOUSAI KAKEKIN] (きぎょうきょうさいかけきん) “company co-insurance premiums”. If you have a previous job, it is also included.

– The amount deducted for the first time in the 年末調整 [NENMATSU CHOUSEI] (ねんまつちょうせい) “year-end adjustment”.

A breakdown of these deductions is provided at the bottom of your 源泉徴収票 [GENSEN CHOUSYU HYOU](げんせんちょうしゅうひょう) “withholding tax form”.

For example, there are the following deductions

<Examples of deductions that are applicable to the year-end adjustment>

- 基礎控除 [KISO KOUJO] (きそこうじょ) “Basic deduction” : a flat deduction for all taxpayers

- 雑損控除 [ZASSON KOUJO] (ざっそんこうじょ) “Deduction for miscellaneous losses” : a deduction for the amount of damage caused by theft or disaster.

- 医療費控除 [IRYOUHI KOUJO] (いりょうひこうじょ) “Deduction for medical expenses” : Deduction for certain hospitalization and nursing care expenses

- 寄付金控除 [KIFUKIN KOUUJO] (きふきんこうじょ) “Deduction for donations” : A deduction that can be applied to the amount of money donated, such as donations for disaster relief

- 障害者控除 [SHOUGAISHA KOUJO] (しょうがいしゃこうじょ) “Disability exemption” : a deduction for taxpayers with disabilities who are disabled themselves or have dependents

- 寡婦(夫)控除 [KAFU KOUJO] (かふこうじょ) “Widow (husband) exemption” : Exemption for divorced or deceased spouses with children to support

- 勤労学生控除 [KINROU GAKUSEI KOUJO] (きんろうがくせいこうじょ) “Deduction for working students” : students who are working with a salary and whose income is below the level of the income level.

- 扶養控除 [FUYOU KOUJO] (ふようこうじょ) “Exemption for dependents”: a deduction that can be applied when there is a family member to support

- 配偶者控除 [HAIGUSHA KOUJO] (はいぐうしゃこうじょ) / 配偶者特別控除 [HAIGUSHA TOKUBETU KOUJO] (はいぐうしゃとくべつこうじょ) “Spousal exemption” / “Spousal special exemption” : deduction for a spouse with an income below a certain level

④ 源泉徴収額 [GENSEN CHOUSYU GAKU] (げんせんちょうしゅうがく)

The total amount of income tax collected in a year.

① 給与所得控除後の金額 [KYUYO SHOTOKU KOUJO GO NO KINGAKU] ー ②所得控除の額の合計額 [SHOTOKU KOUJO NO GAKU NO GOUKEI GAKU]

=課税対象額 [KAZEI TAISHOU GAKU] (かぜいたいしょうがく) “the taxable amount”

This taxable amount is multiplied by the tax rate and it becomes the amount of 源泉徴収額 [GENSEN CHOUSYU GAKU] (げんせんちょうしゅうがく).